The Intriguing World of Insurance is a subject that often sparks mixed feelings. On one hand, it’s seen as a necessary expense—something you pay for but hope you never have to use. On the other hand, it’s a safety net, offering peace of mind and financial security in an unpredictable world. But what aspects of insurance are people most intrigued by? Let’s explore the elements of insurance that capture the most interest.

1. The Mystery of Premium Calculation

One of the most fascinating—and sometimes frustrating—questions people have about insurance is, “How are premiums calculated?” Insurance premiums can seem like a black box, with various factors contributing to the final number. People are curious about how their age, lifestyle, health, location, and even credit score can influence the cost of their insurance. The idea that something as intangible as “risk” can be quantified and priced is both intriguing and perplexing. Many are keen to understand how they can lower their premiums by making lifestyle changes or choosing different coverage options.

2. The Evolution of Insurance Products

Insurance is not static; it evolves with societal changes and technological advancements. Today, people are particularly interested in how insurance products are adapting to modern needs. For example, the rise of telematics in car insurance—where premiums are based on driving behavior monitored by GPS—has piqued the interest of tech-savvy consumers. Similarly, the emergence of cyber insurance to protect against digital threats is a hot topic. People are curious about how these new types of insurance work, what they cover, and whether they are worth the investment.

3. The Role of Insurance in Major Life Events

Insurance becomes particularly relevant during significant life events, such as buying a home, starting a family, or retiring. People are interested in how different types of insurance can protect them during these milestones. For instance, when purchasing a home, the importance of homeowners insurance suddenly becomes crystal clear. When starting a family, life insurance moves to the forefront as a way to ensure financial stability for loved ones. Understanding the role insurance plays during these pivotal moments makes it a topic of keen interest.

4. The Claims Process: What Really Happens?

The insurance claims process is another area that garners a lot of attention. It’s one thing to pay premiums regularly, but quite another to navigate the process when you need to make a claim. People are interested in what happens behind the scenes when they file a claim. They want to know how claims are evaluated, how long the process takes, and what factors might lead to a claim being denied. Understanding the claims process helps policyholders feel more confident that they will be treated fairly when the time comes.

5. The Concept of Self-Insurance

With the growing trend of financial independence and personal responsibility, some people are exploring the concept of self-insurance. This involves setting aside personal funds to cover potential losses rather than paying premiums to an insurance company. While this isn’t feasible for all types of insurance, such as health or car insurance, it’s an intriguing idea for certain risks, like covering a high deductible or minor home repairs. People are interested in understanding the risks and rewards of self-insurance, and how it can fit into a broader financial strategy.

6. The Ethical Side of Insurance

Insurance is more than just a financial product; it also raises important ethical questions. People are increasingly interested in how insurance companies operate from a moral standpoint. This includes issues like how insurance companies handle claims in disaster situations, their investment practices, and their approach to social responsibility. With the rise of “green” insurance products and companies that prioritize ethical practices, consumers are paying more attention to the values of the companies they do business with.

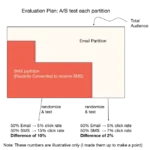

7. The Impact of Artificial Intelligence and Big Data

In recent years, the use of artificial intelligence (AI) and big data in insurance has become a topic of great interest. People are curious about how these technologies are changing the insurance landscape. For example, AI can streamline the claims process, making it faster and more accurate. Big data can help insurers better assess risk and personalize policies. However, there are also concerns about privacy and the potential for algorithmic bias. The intersection of technology and insurance is a rapidly evolving area that captivates many.

8. The Future of Health Insurance

Health insurance remains one of the most critical and debated types of coverage. People are deeply interested in the future of health insurance, especially in the context of rising healthcare costs and political changes. Questions about the sustainability of current models, the potential for universal coverage, and the role of private versus public insurance are hot topics. Additionally, with the advent of telemedicine and personalized medicine, there’s growing interest in how health insurance will adapt to new healthcare delivery models.