Mutual of Omaha is a name synonymous with trust, financial security, and a commitment to serving individuals and families across the United States. Founded over a century ago, Mutual of Omaha has grown into one of the nation’s most respected insurance and financial services companies. With a rich history, a diverse range of products, and a forward-looking approach to meeting the needs of its customers, Mutual of Omaha continues to be a leader in the industry. In this article, we’ll explore the company’s origins, its core offerings, and its vision for the future.

A Century of Service: The History of Mutual of Omaha

Mutual of Omaha was founded in 1909 by Dr. C.C. and Mabel Criss in Omaha, Nebraska. Originally known as Mutual Benefit Health & Accident Association, the company was established to provide health and accident insurance to workers in the Midwest. The Crisses were driven by a mission to offer affordable and reliable insurance coverage to help people protect their financial future.

Over the years, the company expanded its product offerings and grew its customer base. In 1950, the company adopted the name Mutual of Omaha, reflecting its broader scope of services and its commitment to serving customers nationwide. The company became a household name, particularly through its sponsorship of the iconic television program “Mutual of Omaha’s Wild Kingdom,” which aired from 1963 to 1988 and is widely credited with raising awareness about wildlife conservation.

Today, Mutual of Omaha continues to be a mutual company, meaning it is owned by its policyholders rather than shareholders. This structure allows the company to prioritize the needs of its customers and focus on long-term stability and customer satisfaction.

Comprehensive Product Offerings

Mutual of Omaha offers a wide range of insurance and financial products designed to help individuals and families achieve financial security. The company’s offerings include:

- Life Insurance

- Mutual of Omaha provides a variety of life insurance products, including term life, whole life, and universal life insurance. These products are designed to meet different needs, whether it’s providing financial protection for loved ones, building cash value, or offering flexible coverage options. The company’s life insurance policies are known for their affordability, flexibility, and reliability.

- Health Insurance

- In addition to life insurance, Mutual of Omaha offers health-related products such as Medicare Supplement Insurance, critical illness insurance, and long-term care insurance. These products help customers manage healthcare costs and protect against the financial burden of unexpected medical expenses. Mutual of Omaha is particularly well-known for its Medicare Supplement Insurance, which provides coverage for out-of-pocket expenses not covered by Medicare.

- Disability Income Insurance

- Disability income insurance from Mutual of Omaha provides financial protection in the event that an illness or injury prevents an individual from working. This coverage helps replace a portion of the insured’s income, ensuring that they can maintain their financial stability during a period of disability.

- Annuities

- Mutual of Omaha offers a range of annuity products that help individuals save for retirement and generate income in their retirement years. These products include fixed annuities, indexed annuities, and immediate annuities, each designed to provide a steady stream of income and help manage retirement risks.

- Investments and Retirement Planning

- In addition to insurance, Mutual of Omaha provides investment and retirement planning services. The company offers mutual funds, retirement accounts, and other investment options to help customers grow their wealth and prepare for a financially secure retirement. Financial advisors are available to assist customers in developing personalized strategies to meet their financial goals.

- Employee Benefits

- Mutual of Omaha also serves businesses by offering employee benefits solutions, including group life insurance, disability insurance, and retirement plans. These products help employers attract and retain talent while providing valuable protection and financial security to their employees.

Mutual of Omaha’s Commitment to Innovation and Customer Service

Throughout its history, Mutual of Omaha has maintained a strong commitment to innovation and customer service. The company has continually adapted to the changing needs of its customers and the evolving financial landscape. This commitment is evident in several key areas:

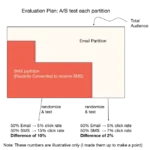

- Technology and Digital Transformation

- Mutual of Omaha has embraced technology to enhance the customer experience and streamline operations. The company has invested in digital tools and platforms that make it easier for customers to manage their policies, file claims, and access information. This includes user-friendly online portals, mobile apps, and digital customer service options that provide convenience and accessibility.

- Customer-Centric Approach

- As a mutual company, Mutual of Omaha’s primary focus is on serving its policyholders. The company is dedicated to providing personalized service and support, ensuring that customers have the information and resources they need to make informed decisions. Mutual of Omaha’s commitment to customer satisfaction is reflected in its high customer service ratings and the trust it has earned over the years.

- Financial Strength and Stability

- Mutual of Omaha has consistently demonstrated financial strength and stability, which is crucial in the insurance industry. The company holds strong ratings from major rating agencies, reflecting its ability to meet its financial obligations and protect its policyholders. This financial strength gives customers confidence that Mutual of Omaha will be there when they need it most.

- Corporate Social Responsibility

- Mutual of Omaha is also committed to giving back to the communities it serves. The company engages in various philanthropic initiatives, including supporting education, health, and social services. Mutual of Omaha’s corporate social responsibility efforts are an extension of its mission to help people achieve financial security and well-being.

The Future of Mutual of Omaha

As Mutual of Omaha looks to the future, it remains focused on its mission of providing financial security and peace of mind to its customers. The company’s future direction will likely include:

- Continued Innovation

- Mutual of Omaha will continue to leverage technology and innovation to enhance its products and services. This includes developing new insurance and financial products that meet the changing needs of customers, as well as improving digital tools and platforms to provide an even better customer experience.

- Expansion of Product Offerings

- The company is likely to expand its product offerings to address emerging risks and financial challenges faced by individuals and families. This could include new types of insurance coverage, investment options, and retirement planning solutions tailored to the needs of different customer segments.

- Focus on Financial Education

- Mutual of Omaha recognizes the importance of financial literacy and is committed to helping customers make informed decisions about their financial future. The company will likely continue to invest in financial education initiatives, providing resources and tools that empower customers to take control of their finances.

- Sustainability and Corporate Responsibility

- Mutual of Omaha will likely continue to prioritize sustainability and corporate responsibility, focusing on initiatives that benefit society and the environment. This includes reducing the company’s environmental footprint, supporting charitable causes, and promoting diversity and inclusion within the organization

![The Rise of Freelancing: Why [Insert Country Here] Is the Top Freelancer Nation](https://apksk.online/wp-content/uploads/2024/08/download-768x512.webp)

One thought on “Mutual of Omaha : A Legacy of Trust and Financial Security”